Short Selling is a trading strategy used by investors to profit from a decline in a security’s price. The investor borrows shares from another investor, sells them at the current market price, and then buys back the shares at a lower price to return to the lender and pocket the difference as profit. The short seller is betting that the price of the security will fall and they can purchase the shares at a lower price to make a profit.

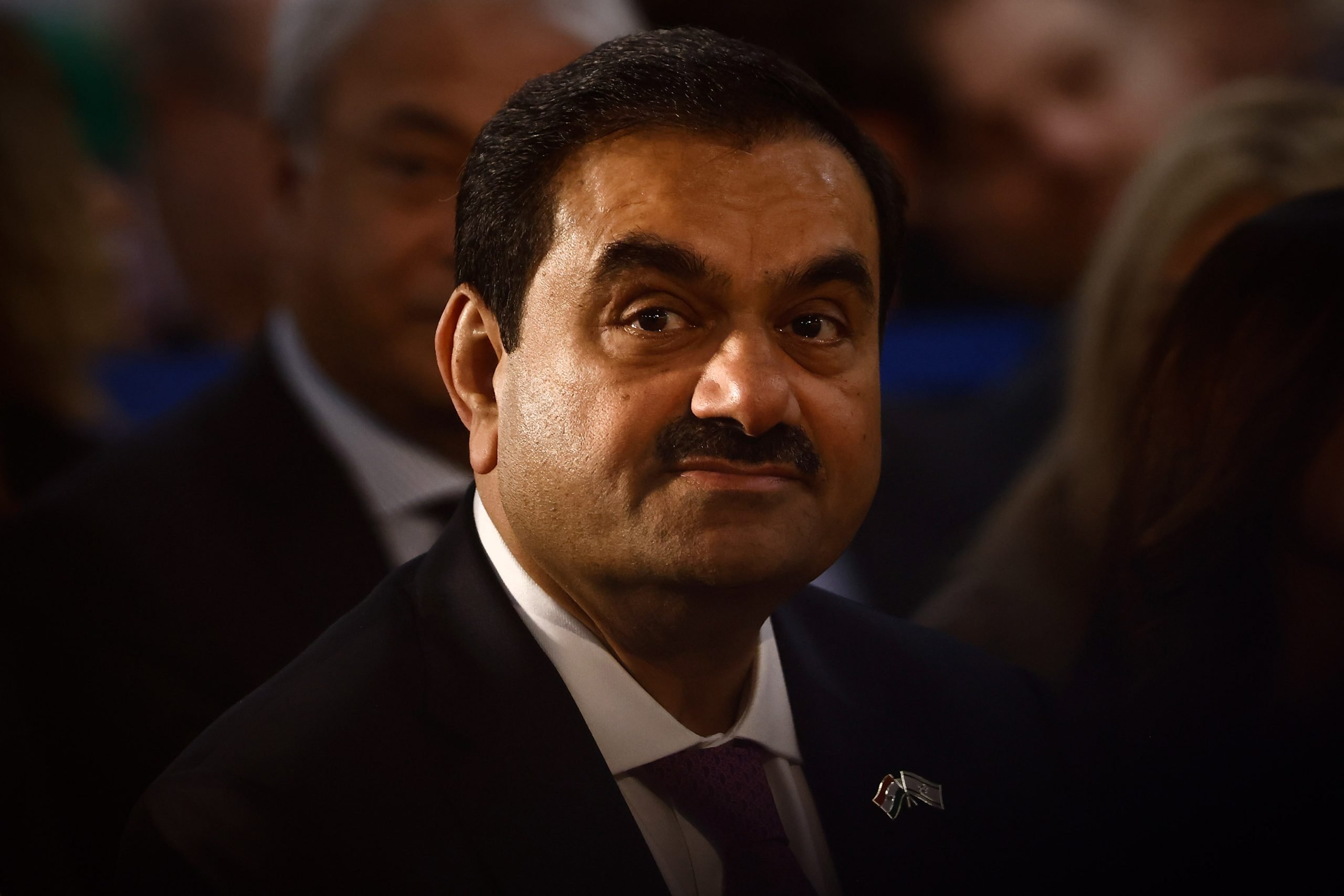

Adani and Hindenburg are two examples of how short selling can impact a company and its stock price. Adani Group is an Indian conglomerate company that has faced criticism and controversy in the past, leading to short sellers betting against the company. In 2023, Hindenburg Research published a report alleging financial irregularities at Adani Group, causing the stock price to fall, and short sellers to profit.

On the other hand, Hindenburg Research is a well-known short-selling firm that investigates companies and publishes reports with negative findings in an attempt to drive down the stock price and profit from short selling. In 2021, Hindenburg published a report on electric vehicle manufacturer Nikola, alleging fraud and deception, causing the stock price to fall and short sellers to profit.

While short selling can be a profitable strategy for some investors, it also brings a level of risk and potential for market manipulation. Short selling can drive down the price of a security, leading to a negative impact on the company and its stakeholders. Additionally, if the stock price does not fall as expected, the short seller may have to purchase shares at a higher price, resulting in significant losses.

In conclusion, short selling is a trading strategy that allows investors to profit from a decline in a security’s price, but it also brings with it a level of risk and potential for market manipulation. The Adani and Hindenburg examples demonstrate how short selling can impact a company and its stock price.