SpaceX’s Starlink – a constellation of low-orbit broadband satellites – has won a key Indian license, clearing a major hurdle to launching services in the world’s second-largest internet market. Starlink consists of thousands of small satellites beaming high-speed, low-latency internet to ground receivers. The recent Department of Telecommunications (DoT) license (a GMPCS authorisation) means Starlink can now prepare its ground infrastructure and secure spectrum to offer broadband in India. This matters because India’s massive but unevenly connected population – now ~954 million internet users – still sees huge gaps in rural access. Only about 398 million of those users are in rural areas, and fixed broadband lines number only ~41 million (versus 904 million mobile users). In short, many millions – from farmers to mountaineers – rely on flaky wireless links. A satellite ISP like Starlink could transform connectivity where fiber or towers can’t reach.

Also Read: Elon Musk’s Starlink Gets Licence to Launch Satellite Internet in India Amid Feud With Trump

What Is Starlink and Why This License Matters?

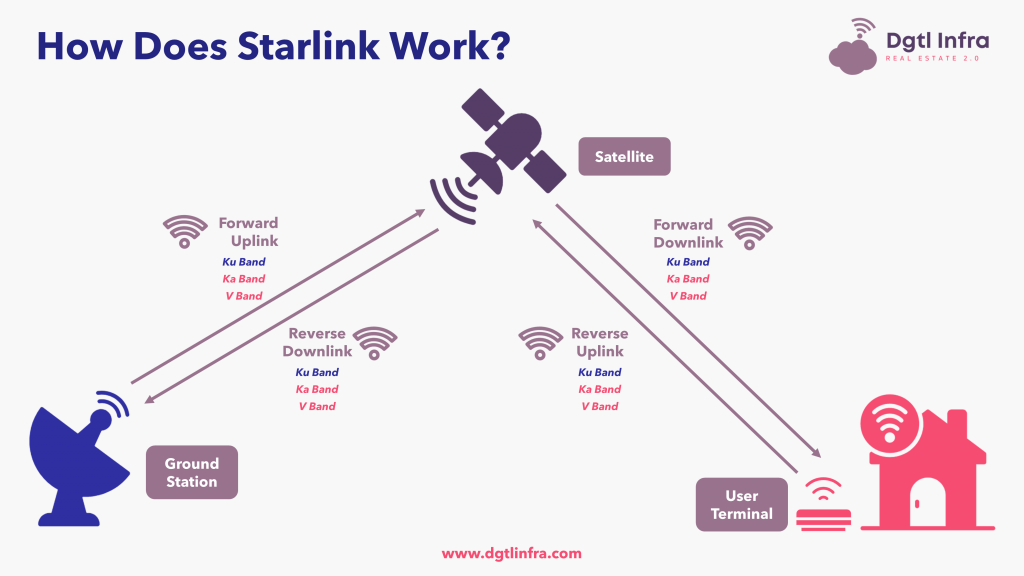

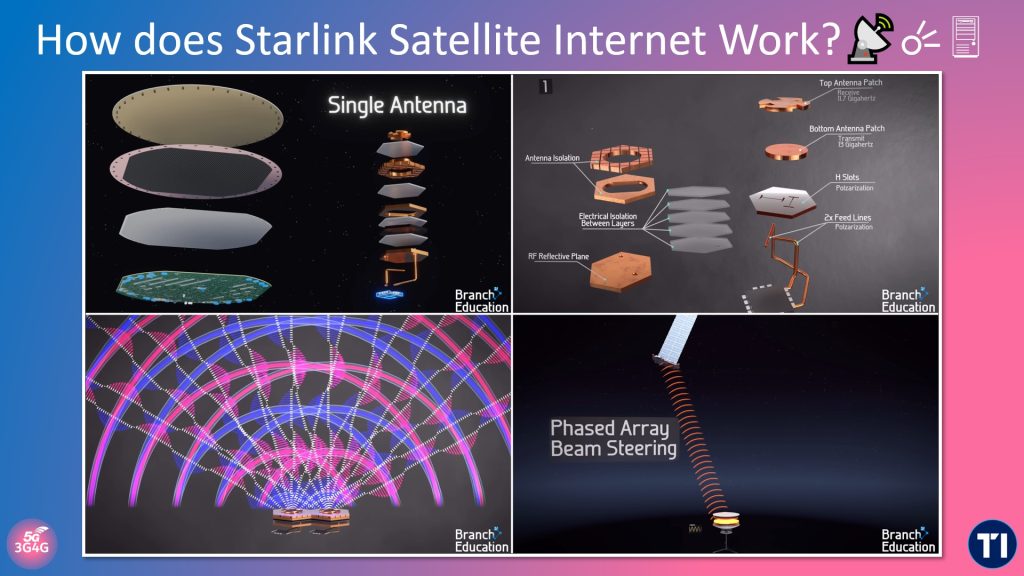

Starlink is SpaceX’s satellite internet service. It now operates nearly 7,000 small satellites (planned to reach tens of thousands) in low Earth orbit. Each satellite relays user data between dish terminals on the ground and the internet backbone. Globally, Starlink already serves roughly 4.6 million subscribers as of 2024, offering download speeds of 50–200 Mbps in many locations. Its appeal has been proven in crises: for example, Starlink became “the backbone of the Ukrainian army” during Russia’s invasion, and it has helped restore service after natural disasters. The DoT license news means SpaceX can commercially launch Starlink in India. Reuters notes Starlink is the “third company” (after OneWeb/Eutelsat and Reliance Jio’s satellite venture) to get such DoT approval. The Indian license follows a Letter of Intent issued in May 2025 and comes after months of government review of Starlink’s security and investment plans. It signals that regulators have accepted SpaceX’s commitments (such as data localization, lawful interception, and local hardware inspection) that were negotiated over the past year.

India’s Digital Landscape: Challenges and Gaps

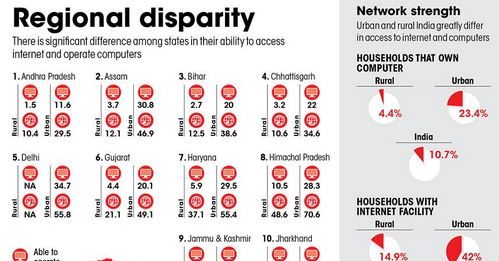

India has dramatically expanded Internet access in recent years – about 95% of villages now have 3G/4G mobile coverage. By March 2024, India had 954.4 million total Internet subscribers, including 398.35 million rural users. The government’s BharatNet program has laid fiber to roughly 213,000 of 222,000 planned village hubs, connecting most Gram Panchayats by optical cable. Yet despite this progress, broadband penetration remains low outside cities. There are only ~41 million fixed broadband lines in the country – dwarfed by 904 million wireless connections. As the Atlantic Council notes, India’s economy is essentially “mobile-first”, with vast rural areas lacking high-speed wired broadband. Many connected homes and businesses still struggle with slow speeds, spotty signals, or expensive satellite TV hookups as their only option. In short, a huge “last-mile” gap persists in India’s network: remote valleys, mountains, islands and forests are still offline or on slow mobile links. This connectivity challenge – compounded by tough terrain and electrification gaps – is exactly the market Starlink aims to serve.

Potential Impact: Education, Health, Defense and Emergency Use

With its tall coverage footprint, Starlink could unlock many sectors:

- Education & Telemedicine: Reliable satellite broadband can bring online learning and virtual clinics to village schools and health centers. Experts say Starlink “can enable access to online education, telemedicine and e-commerce” for remote communities. Teachers could livestream classes and students could tap global resources via video calls; doctors could run remote diagnostics and training. This especially helps regions where digital devices exist but network bandwidth is missing.

- Local Economic Development: Fast internet enables e-commerce, mobile banking and digital services in areas previously cut off. Economist Ramesh Gupta notes “access to high-speed internet can be a game changer for rural economies”. Artisans, farmers and small entrepreneurs could sell products online, access market prices and digital payments, helping lift incomes and create jobs. Broadband also attracts new businesses (e.g. tech-enabled agriculture, tourism lodges) to villages.

- Government Services: Satellite links could power digital government initiatives (e-governance kiosks, online banking, welfare schemes) in places without reliable cellular coverage. For example, district offices or emergency services on high plateaus could offer 24×7 connectivity via Starlink.

- Defense and Border Connectivity: India’s military doctrine calls space communications a “force multiplier”. Starlink could provide secure voice/data links to remote army posts in the Himalayas, Andaman Islands or patrolled deserts – areas where laying cables or erecting towers is impractical. In Operation Shakti (2019), India tested anti-satellite weapons partly to protect its space systems – signals of how vital space connectivity is seen for security. Conversely, authorities worry that satellites could bypass their controls: in late 2024, Indian forces found Starlink dish units reportedly smuggled by militants in Manipur and by drug traffickers at sea, prompting scrutiny over “any satellite internet near sensitive borders.”

- Emergency & Disaster Response: Starlink’s terminals can be quickly deployed in natural disasters (floods, cyclones, earthquakes) when terrestrial networks fail. The service has already been donated for disaster relief in places like Papua New Guinea and the Philippines. In India, officials envision Starlink aiding cyclone relief in the Bay of Bengal or communications in earthquake-hit Himalayas, as “critical communication infrastructure during emergencies”.

Overall, telecom analysts and officials believe satellite broadband will “bridge the last-mile connectivity gap”. Communications Minister Scindia observes that “in regions where no telecom tower can reach … satellite is the only option”. Adding Starlink gives more tools – not less – for national connectivity. For example, Railways Minister Ashwini Vaishnaw even welcomed Starlink on X/Twitter, noting it will benefit remote rail projects and tribal communities along tracks

The Satellite Internet Race: Competitors and Partners

Starlink is entering a market already heating up. India’s top telcos and space agencies are racing to launch their own services:

- Reliance Jio (JioSpaceFiber): Jio Platforms formed a joint venture with Luxembourg’s satellite firm SES to use SES’s medium-earth-orbit satellites. Called JioSpaceFiber, this service is targeting gigabit broadband in hard-to-reach areas. Jio has already demonstrated the service in forests and islands (Gir, Korba, Nabarangpur, Jorhat) with “gigabit speeds”. Their first gateway was approved by IN-SPACe in 2024.

- Bharti Airtel–OneWeb (Hughes India JV): Bharti already co-owns UK-based OneWeb (LEO satellites) through a JV called OneWeb India, and has a distribution deal with Hughes Communications India. OneWeb’s network (launched globally in 2023) will serve India via Aerobridge satellites. Airtel and Hughes plan to offer community Wi-Fi and enterprise broadband for villages, businesses and defense. In fact, Hughes India notes its 2022 launch of India’s first high-throughput satellite (HTS) service – using ISRO’s GSAT-11 and GSAT-29 – already delivers multi-megabit broadband to “the remotest locations”. This example shows ISRO and industry backing satellite access.

- State Space Efforts (NSIL/ISRO): India’s commercial arm NSIL is launching new geostationary satellites (like GSAT-N2 in 2024) to boost rural broadband and in-flight connectivity. While not consumer-facing like Starlink, these state satellites form backup infrastructure for telcos and government users.

- Hughes Networks India: Hughes – which built OneWeb’s India system – also provides VSAT services via leased satellite bandwidth. It already connects hundreds of thousands of Indian business and government sites with satellite links. Hughes’ 2022 HTS service (mentioned above) was aimed at public Wi-Fi and enterprise hotspots, showing how existing players are expanding.

Outside India, global satellite ISPs also eye the market. Amazon’s Project Kuiper plans a mega-constellation and has said it will invest ~$10 billion globally. Reuters notes Kuiper is “still awaiting a licence” in India. Its entry could further increase competition (analysts predict India’s satellite broadband market could reach ~$1.9 billion by 2030). In summary, Starlink enters a field with heavyweights: the homegrown Jio–SES and Airtel–OneWeb ventures, Hughes’ offerings, and potential Kuiper, plus future Indian private constellations (e.g. privately-led nanosatellite networks under IN-SPACe’s vision). Each competitor has different tech (LEO vs MEO/GEO) and partnerships, meaning Starlink won’t dominate by default – it must win customers on service and price.

Regulatory and Other Hurdles Ahead

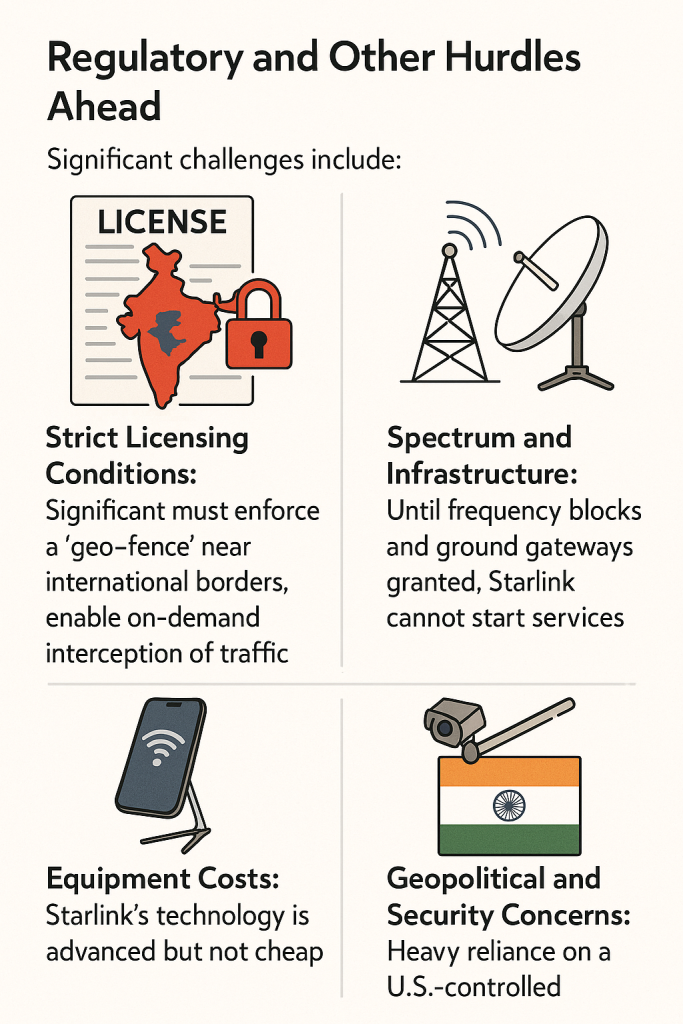

Starlink’s India debut will not be smooth sailing. Significant challenges include:

- Strict Licensing Conditions: The Indian licence comes with tight security rules. For example, providers must enforce a “geo-fence” that blocks terminals near international borders (initially proposed at 10 km outside, relaxed to 50 km inside), and enable on-demand interception of traffic. They must localize servers, allow real-time tracking, and even plan for some local manufacturing of user terminals. These requirements are more onerous than in many countries. SpaceX has publicly argued that some rules (like the border eavesdropping clause) are impractical. Indian officials eventually eased a 10 km exclusion to 50 km inside the border and removed a forced Indian-majority-ownership rule – but data residency and compliance checks remain mandatory.

- Spectrum and Infrastructure: Unlike 5G spectrum auctions, India is using administrative allocation for Satcom spectrum. Incumbent telcos (Reliance Jio, Airtel) objected that satellite players pay only 4% of revenue as license fee (versus 21% for radio spectrum). They fear unfair pricing, and some have publicly lobbied for auctions. The final TRAI spectrum policy is pending; current recommendations include 4% AGR charges and per-user surcharges. Until actual frequency blocks and ground gateways are granted, Starlink cannot start services. Building dozens of gateway stations across India (and importing/making thousands of user dishes) is a major logistical task.

- Equipment Costs: Starlink’s technology is advanced but not cheap. Globally, a user kit costs several hundred dollars (roughly ₹30,000–40,000) and monthly plans run $100–$120. That may be steep for rural Indians, even with discounting. Reports suggest SpaceX may offer introductory plans as low as ₹840 ($10) per month to gain early adopters. It remains to be seen if Indian pricing can match ultralow-cost mobile broadband, which rivals often boast is among the world’s cheapest (less than $1 per GB).

- Competition from Mobile Broadband: Basic internet on mobile phones is already very cheap in India. Many analysts note that basic data needs (social media, calls) are met with 4G/5G coverage in many villages. Convincing users to buy new hardware for “home broadband” may be a hard sell unless speeds or latency are dramatically better. Established satellite VSAT services (Hughes, Octagon) already cover government and enterprise with specialized equipment, but consumer penetration is negligible. Starlink will have to build demand by proving its advantages.

- Geopolitical and Security Concerns: Some observers warn that heavy reliance on a U.S.-controlled constellation could raise sovereignty and security questions. India has historically restricted satellite phones and encryption in sensitive regions. As noted, Indian forces have already confiscated Starlink units during counter-insurgency and anti-smuggling ops. While SpaceX says it “turned off” beams over India at those times, the incidents underscore worries that adversaries (or even citizens) could use unmonitored channels. In response, New Delhi will insist on its surveillance rules being enforced.

In short, Starlink must navigate India’s unique regulatory and market landscape. Telecom experts from incumbent firms warn of a “front-loaded investment” for satellite ISPs (cost of satellites and launch) and cite new license fees that will raise prices. On the positive side, the government has signaled willingness to adapt norms (it lifted the foreign-ownership barrier and is setting dedicated satcom rules). But as one source put it, obtaining final space-licence clearance and spectrum could take “a couple of months at least,” and only then can sales begin.

Will the Recent Trump–Musk Conflict Change Starlink’s Role in India?

India’s recent decision to grant Starlink a license to offer satellite communication services marks a turning point in its digital and connectivity ambitions — especially for remote and underserved areas. However, the timing of this approval coincides with growing tensions between Elon Musk and former US President Donald Trump, raising important strategic questions.

While the dispute may seem personal or domestic to the US, it has geopolitical implications. If Musk’s companies, including Starlink, come under political pressure in the US, their global operations — including in India — could face policy volatility. For instance, a future Trump-led administration may adopt a stricter or unpredictable stance towards companies like SpaceX, potentially affecting technology transfers, regulatory support, or global expansion plans.

For India, which is relying on Starlink to bridge the rural–urban digital divide, this creates a dilemma: Can it afford to depend on a foreign private player entangled in US political turbulence for critical communication infrastructure? Especially as satellite internet becomes central not just to civilian life but also disaster response, defense connectivity, and strategic autonomy.

In response, India might accelerate development of its indigenous alternatives like ISRO’s GSAT constellation, NavIC, or even back OneWeb (with Bharti Global as a key stakeholder) to ensure redundancy and national security insulation — especially if Starlink becomes a pawn in global tech geopolitics.

Also Read: Musk Blasts Trump Over ‘Big Beautiful Bill’, Claims Credit for 2024 Election Win

What Experts and Officials Say

Industry voices are mixed. Communications Minister Jyotiraditya Scindia is bullish: he says Starlink’s Letter of Intent is issued and the licence process “is almost complete”. Scindia emphasizes that satellite internet will “bridge India’s last-mile gap”, especially in places where “no telecom tower can reach”. He frames it as giving “consumer choice” – not displacing fiber or 5G, but adding an alternative. Similarly, tech ministers have publicly welcomed Starlink’s arrival. For instance, Railways Minister Ashwini Vaishnaw posted “Starlink, welcome to India!” noting its usefulness for remote projects. Development analysts also applaud the move: one telecom analyst calls the government’s “proactive stance” on satellite broadband “commendable” for addressing connectivity gaps.

On the other hand, domestic operators are wary. The Cellular Operators’ Association of India (COAI) – whose members include Reliance Jio and Airtel – recently petitioned TRAI arguing that satcom licence fees (4% of revenue plus small spectrum charges) are too low, and that fair play requires parity with 5G spectrum fees. COAI fears that ultra-cheap satellite plans could undercut their massive fiber and tower investments. Even Jio and Airtel themselves, who have deals to sell Starlink terminals in their stores, will also compete with it in broadband offerings. In sum, experts note the market could become fiercely competitive. A report predicts India’s sat-broadband market hitting ~$1.9 billion by 2030, making it lucrative – but only if pricing and services match local needs.

Strategic and Geopolitical Implications

The Starlink case is as much about geopolitics as tech. India has long championed strategic autonomy in space (building its own satellites, launching others’ payloads, and even developing anti-satellite missiles). Yet its recent policies show closer alignment with the U.S. space industry. Think-tank analysts note India is “embracing commercialization and privatization of space, aligning itself with the U.S. and other major space powers” while still tightly regulating foreign firms. Starlink’s entry – occurring just after PM Modi’s high-profile U.S. visit with Elon Musk – fits this pattern. It underscores deepening US–India tech ties: in 2021 the Quad group (U.S., India, Japan, Australia) even launched a space cooperation working group for shared satellite data and standards. The CFR’s space policy memo observes that deals like these (Starlink with Jio/Airtel) are happening under “New Delhi’s terms,” reflecting a hybrid approach of opening markets under strict oversight.

For India’s military planners, having a trusted U.S. partner in orbit may also help counter regional adversaries. Chinese satellite providers (through Huawei/AsiaSat) and Russian links have dominated Asian telecom; a robust Starlink network would give India alternative secure channels near the Sino-Indian and Pak-Afghan borders. In the Doklam or Galwan regions, for instance, if terrestrial infrastructure is limited or cut off, Starlink could maintain line-of-sight comms. That, however, depends on security rules allowing terminals in those zones – which is why initial draft rules actually restricted coverage near borders.

On diplomacy, Starlink ties into wider “space-tech diplomacy.” India has used satellites to build alliances (the South Asia Satellite project for neighbors, proposals for G20 climate satellites). Allowing a high-profile American satellite venture to operate could signal to partners (and rivals) that India’s space market is open and U.S.-India cooperation is strong. But some critics worry about dependency: The Diplomat warns of an “uncritical reliance on U.S. tech” potentially undermining India’s own technological goals. The balanced view is: India seeks to be a global space partner for others, building systems to serve the Global South, but it will do so on its own regulatory terms. In the near term, hosting Starlink operations demonstrates India’s growing role in space governance (it already co-chairs UN working groups on space sustainability) and its readiness to welcome transnational tech – albeit cautiously.

Looking Ahead: Rollout, Pricing, and the Road to Service

With the licence now in hand, what comes next for Starlink India? First, SpaceX must obtain final approval from IN-SPACe (India’s new space regulator) to land its satellites’ signals into the country. Then it will undergo spectrum tests – several other providers (like OneWeb and Jio) have already been granted trial frequencies on a limited basis. Industry sources tell TechCrunch that from this point “official rollout” might take another 6–9 months. In practice, that means Starlink could feasibly start selling user terminals by late 2025 or early 2026, assuming no further delays.

SpaceX has not announced pricing for India’s market, but reports suggest aggressive rates. In Bangladesh Starlink hardware sells for ~$385 (BDT 47,000) with service ~$49–$110 per month. A recent media report claims Starlink plans “unlimited” broadband in India for about ₹840/month (≈$10) – a figure that would undercut current offerings by a wide margin. Even if subsidies or contracts bring the initial hardware cost down, local regulatory fees (TRAI’s recommended ₹500/user fee in cities and 4% revenue share) could push prices up. How Starlink chooses to price its kits and plans will be critical.

In terms of partnerships, we already know Jio and Airtel intend to stock and service Starlink equipment in their stores. If Starlink launches first, those stores could quickly gain retail footfall. Conversely, Starlink may seek tie-ups with the new BharatNet authority or local ISPs to plug into rural networks. Manufacturing wise, SpaceX might build some ground equipment in India (as INSAT ground stations and even user terminals can be assembled domestically under India’s rules). There is also talk of bundling Starlink with telecom plans, or using it for government projects (e.g. connecting railway sites or government schools in mountains).

Overall, analysts say the next year will be telling. If Starlink delivers as promised – robust speeds, easy installation, seamless handoff – it could rapidly sign up tens of millions of households in underserved regions. Even incumbent telcos like Airtel and Jio admit they “will still compete with Musk’s offerings” once it’s live. That points to a radically new broadband landscape: fibre, 5G, and satellites all vying side by side. The Indian government’s satellite push (BharatNet 2.0 and new ISRO projects) will proceed in parallel, but now consumers will indeed have a choice. As Communications Minister Scindia put it, this is about choice: “It is not about platform competition; it is about giving consumers a choice” in how they connect.

Conclusion: A Satellite Leap, with Limits

Starlink’s Indian debut is a milestone – a big step toward solving India’s persistent connectivity gaps. Its thousands of LEO satellites promise to beam broadband across deserts, forests and snowbound plateaus where wires never could go. If executed well, Starlink could supercharge digital education, healthcare and economy in remote India. However, its success will hinge on navigating India’s complex regulatory maze, localizing its operations, and offering affordable service. The on-ground rollout, partnerships and pricing strategies over the coming months will tell us how transformative Starlink truly is. For now, both enthusiasts and sceptics agree: India’s connectivity revolution just got a powerful new player, and the country is ready to watch closely as it unfolds.