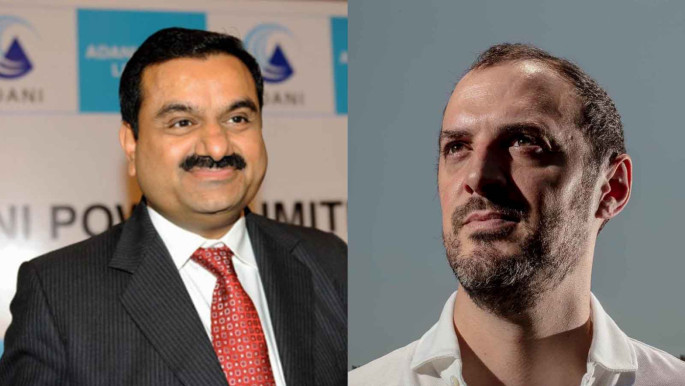

Adani vs. Hindenburg is a recent high-profile showdown between two of the biggest names in the investment world. Adani Group, a conglomerate based in India, and Hindenburg Research, a US-based short-seller and activist investor, have been locked in a battle over market stock since Hindenburg released a report in 2023 alleging that the company was engaging in fraudulent activities. In this article, we will examine the events leading up to this clash, the arguments put forward by both sides, and the potential impact of the outcome on the Indian stock market.

Adani Stock Controversy

Adani Stock, a subsidiary of Adani Enterprise, is one of the largest companies in India. In Jan 2023, Hindenburg Research released a report alleging that the company was engaging in fraudulent activities, including inflating revenue, misstating its cash balance, and hiding its debt levels. The report was widely circulated and sparked a sharp drop in Adani Stock price. Adani Enterprise issued a public statement denying the allegations and calling the report “baseless.”

Adani’s Response

Adani Group has taken a strong stance against Hindenburg’s allegations, calling the report “baseless” and “an attempt to manipulate the stock price.” The company has also taken legal action against Hindenburg, claiming that the report was defamatory and damaged its reputation. Adani also called off its fully subscribed FPO on 1 Feb 2023.

Hindenburg’s Counterargument

Hindenburg, for its part, has stood by its report, calling it a “thorough investigation” that uncovered “compelling evidence” of fraudulent activities by Adani Stock. The short-seller has also pointed to other recent controversies involving Adani Group, including allegations of stock price manipulation, as evidence of the company’s questionable business practices.

Impact on the Indian Stock Market

The Adani vs. Hindenburg showdown has captured the attention of investors and the financial community in India and abroad. The outcome of this battle will likely have a significant impact on the Indian stock market and the reputation of Adani Stock and Adani Enterprise. If the allegations made by Hindenburg are proven to be true, it could lead to further losses for Adani Stock and could damage Adani’s reputation and ability to secure future funding. On the other hand, if Adani’s allegations of defamation and manipulation are proven to be true, it could have a negative impact on Hindenburg’s reputation and its ability to conduct future short-selling campaigns.

Conclusion

Adani vs. Hindenburg is a high-profile showdown between two of the biggest names in the investment world over control of stock market. The outcome of this battle will have a significant impact on the Indian stock market and the reputation of Adani Stock and Adani Enterprise. Regardless of the outcome, it is important for investors and the public to remain vigilant and to thoroughly research and analyze all investment opportunities to ensure that they are making informed decisions.